Closing Entries Financial Accounting

Unless a lender waives a ratio-based covenant violation, it can result in penalties, higher interest rates, or even default. The courses are carefully curated to arm you with in-demand skills that make you stand out to employers. They cover not just the nitty-gritty of accounting principles but also prepare you for the revered CPA certification—crucial if you’re aiming for the upper echelons of the accounting world.

- Reinvesting profits back into the business can help it expand and become more successful over time.

- If a supplier sold merchandise to a company on credit, the supplier is a creditor.

- The act of appropriation does not increase the cash available for the acquisition and is, therefore, unnecessary.

- Retained earnings are part of a company’s equity account and a debit to this account decreases the balance while a credit increases it.

- This amount includes all income that has been generated before the deduction of expenses and it is commonly referred to as gross sale.

- When shares of stock are issued for noncash items, the items and the stock must be recorded on the books at the fair market value at the time of the exchange.

- State laws often require that a corporation is to record and report separately the par amount of issued shares from the amount received that was greater than the par amount.

Appropriation of Retained Earnings (Journal Entries)

The call price might be the face or par amount plus one year’s interest or how is sales tax calculated dividend. Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars. Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles. Sales are reported in the accounting period in which title to the merchandise was transferred from the seller to the buyer.

Accumulated Other Comprehensive Income

This retained profit becomes an essential part of the equity section of a company’s balance sheet, acting as an indicator of financial health and stability. Companies often discuss their retained earnings in newsletters and blogs to communicate their financial strategies and performance to stakeholders. If the “loss” is larger than the credit balance, part of the “loss” retained earnings credit balance is recorded in Paid-in Capital from Treasury Stock (up to the amount of the credit balance) and the remainder is debited to Retained Earnings.

Q: Is Retained Earnings an asset?

Earnings per share must appear on the face of the income statement if the corporation’s stock is publicly traded. The earnings per share calculation is the after-tax net income (earnings) available for the common stockholders divided by the weighted-average number of common shares outstanding during that period. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts.

- Also, mistakes corrected in the same year they occur are not prior period adjustments.

- Revenue is the broad measure of a business’s efficiency at generating sales; it’s the starting line of your financial race.

- The number of issued shares is often considerably less than the number of authorized shares.

- In contrast, when a company suffers a net loss or pays dividends, the retained earnings account is debited, reducing the balance.

- This required accounting (discussed later) means that you can determine the number of issued shares by dividing the balance in the par value account by the par value per share.

Officers of a corporation are appointed by the board of directors Food Truck Accounting to execute the policies that have been established by the board of directors. The officers include the chief executive officer (CEO), the chief operations officer (COO), chief financial officer (CFO), vice presidents, treasurer, secretary, and controller. However, for accounting purposes the economic entity assumption results in the sole proprietorship’s business transactions being accounted for separately from the owner’s personal transactions. Corporations are able to offer a variety of features in their preferred stock, with the goal of making the stock more attractive to potential investors. All of the characteristics of each preferred stock issue are contained in a document called an indenture.

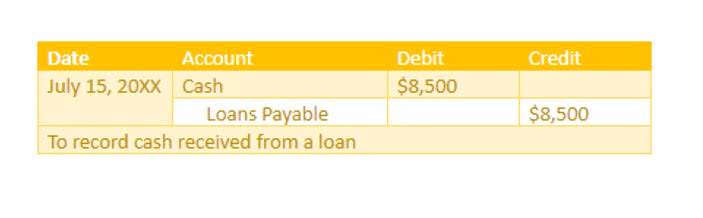

Retained Earnings Journal Entry

The $20 per share times 30 shares equals the $600 that was credited above to Treasury Stock. This leaves a debit balance in the account Treasury Stock of $1,400 (70 shares at $20 each). To illustrate, assume that the organizers of a new corporation need to issue 1,000 shares of common stock to get their corporation up and running. As a result, they decide that their articles of incorporation should authorize 100,000 shares of common stock, even though only 1,000 shares will be issued at the time that the corporation is formed. Some investors may have large ownership interests in a given corporation, while other investors own a very small part.

The other comprehensive income reported on the statement of comprehensive income is added to accumulated other comprehensive income. When a corporation sells some of its authorized shares, the shares are described as issued shares. The number of issued shares is often considerably less than the number of authorized shares. When its articles of incorporation are prepared, a business will often request authorization to issue a larger number of shares than what is immediately needed. Some view the legal complexity of starting and running a corporation to be a disadvantage. To incorporate, an application must be filed with and approved by one of the fifty states, and once approved, the corporation must comply with that state’s regulations.